East Rogers Park Multifamily Market Roars Back in 2024

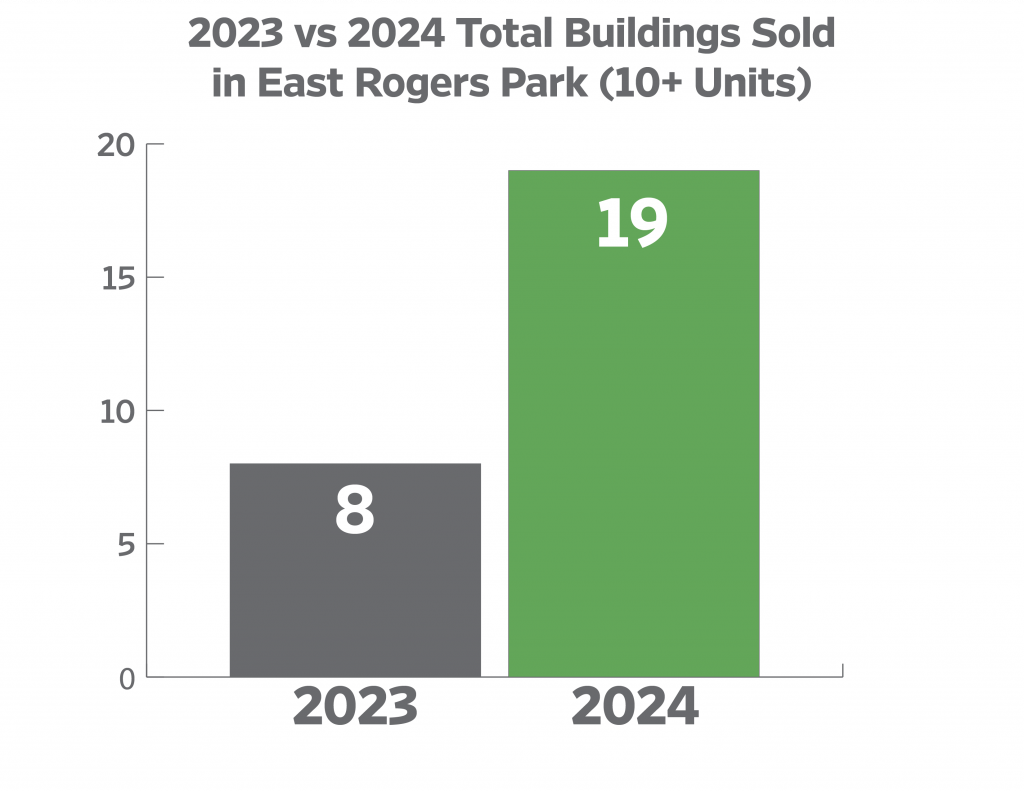

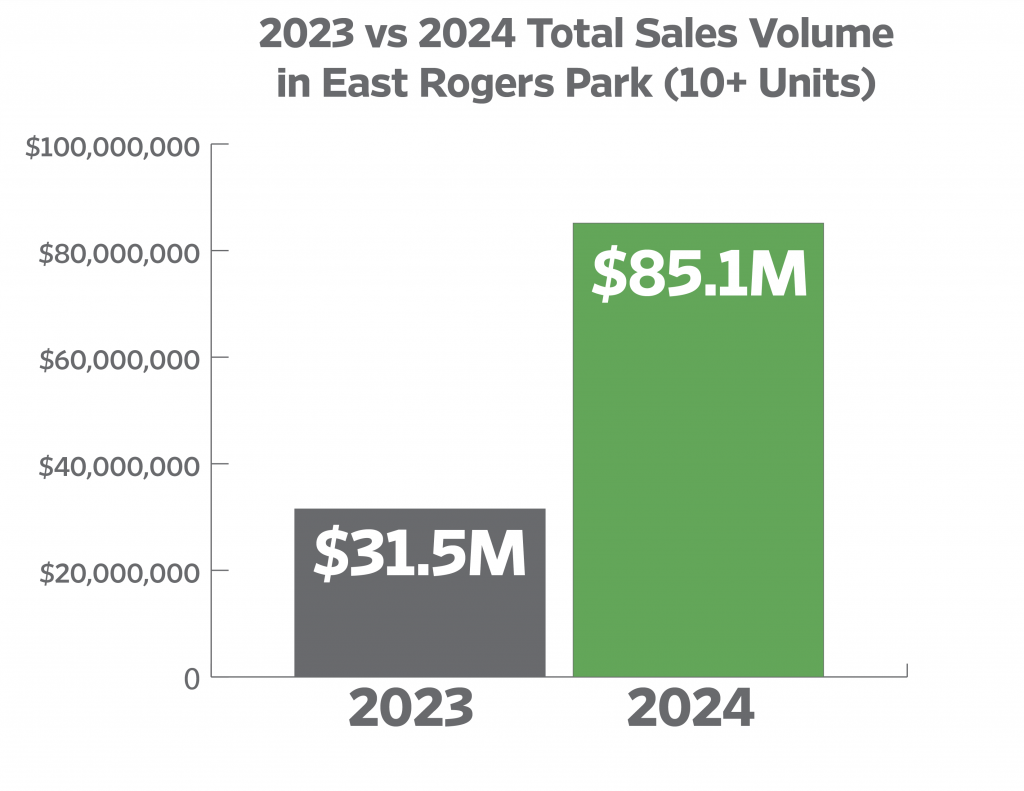

The East Rogers Park multifamily market, bordered to the north by Howard Street and Juneway Terrace, to the south by Devon Avenue, to the west by Ridge Boulevard, and to the east by Lake Michigan, has experienced a major upswing in 2024. Sales volume for 10+ unit assets has skyrocketed 170.1% year-over-year—jumping from $31.5M in 2023 to $85.1M in 2024. The number of transactions more than doubled, rising from 8 to 19, signaling heightened investor confidence and growing demand for mid-market multifamily assets.

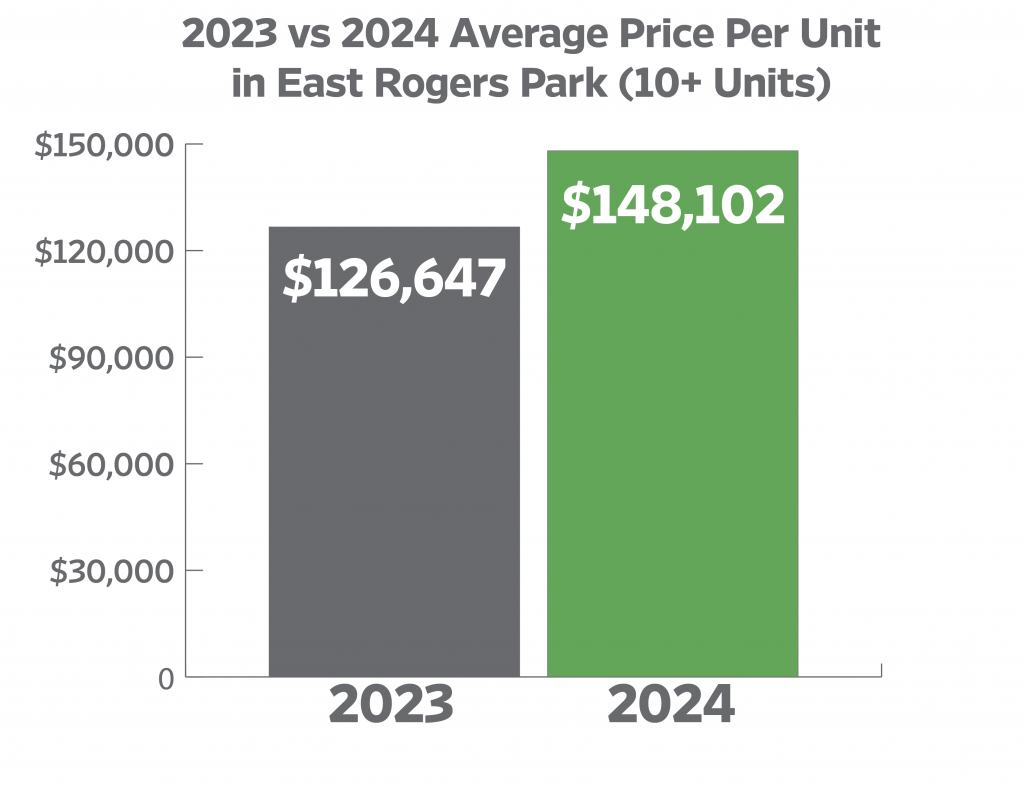

Additionally, the average price per unit rose 16.94%, reaching $148,102, driven by stabilizing interest rates, rising rents, and the conclusion of the property reassessment period. Rental renewal rates in the submarket climbed 5-8% this year, and housing providers saw 10-15% increases for units listed last rental season.

This upswing signals a growing belief in East Rogers Park’s long-term appreciation potential. With its prime lakefront location, excellent public transportation, and proximity to Loyola and Northwestern Universities, the area offers opportunities for both new and seasoned investors. The lower average price per unit, compared to other north-side lakefront neighborhoods like Lakeview and Lincoln Park—where pricing for 10+ unit assets ranged from $162,000 to $375,000 per unit in 2024—creates opportunities for investors to acquire larger buildings and scale their portfolios more quickly.

Please reach out to Kevin Rahmanim directly for detailed data and transaction insights, as well as to discuss multifamily investment opportunities on Chicago’s North Side.

Information cited in this post was compiled from internal data and CoStar.

Kevin Rahmanim is an Associate at Interra Realty. Prior to joining Interra Realty, he spent 6 years as a leasing consultant in Chicago and graduated from the University of Illinois at Chicago. Kevin is a licensed real estate broker in the State of Illinois.