From Recovery to Growth: Pilsen’s 2024 Multifamily Market Success

The multifamily real estate market in Chicago’s Pilsen neighborhood has demonstrated remarkable resilience and growth in 2024, bouncing back strongly after navigating market fluctuations over the past few years. This vibrant community, known for its rich cultural heritage and proximity to downtown, has re-emerged as a hotspot for multifamily investments. The data from 2021 to 2024 underscores this rebound, with significant increases in average sale prices, price per unit (PPU), and a slightly higher cap rate reflecting stronger returns for investors.

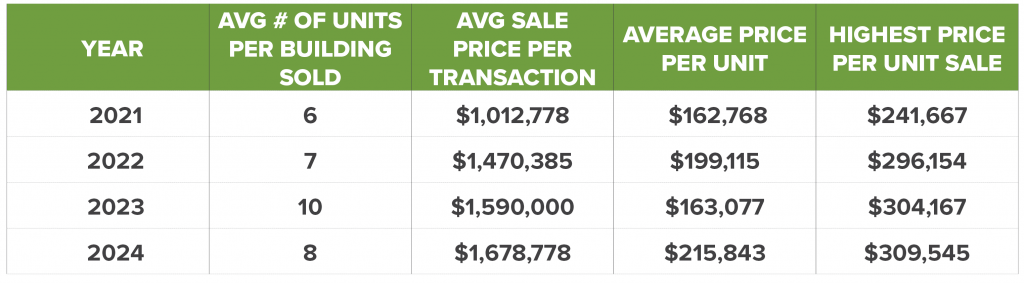

In 2021, the market saw an average sale price of approximately $1,012,778 for properties averaging six units and yielding a PPU average of $162,768. Despite the challenges posed by economic fluctuations in 2023, by 2024, the average sale price surged to $1,678,778—an increase of over 65%—with a slightly higher average of eight units per transaction. The PPU also rose significantly to $215,843—an increase of 32%—reflecting increased demand and confidence in the area. Another metric worth paying attention to is the highest price per unit sale per year which saw an impressive sale of $309,545 per unit max versus a max per unit of $241,667 in 2021.

This recovery can be attributed to several key factors, including Pilsen’s growing desirability, evidenced by the steady increase in average rental rates, improved economic conditions, and ongoing development projects that have significantly boosted the neighborhood’s appeal to both investors and residents. With average sale prices and per-unit values reaching their highest levels in four years, Pilsen’s multifamily market is positioned for sustained growth, presenting exciting opportunities for both new and experienced investors alike.

Jeremy Morton is a Managing Director at Interra Realty. Jeremy graduated from Indiana University and is a licensed real estate broker in the State of Illinois.