OPPORTUNITIES ABOUND IN THE MIDDLE MARKET

For multifamily investors in Chicago, 2025 is a crucial year in which opportunities will be plentiful. Real estate fundamentals remain strong: market-wide vacancy rates have compressed to the 4-5% range, and new supply is extremely limited, forecasting rent growth trajectory beyond 4% through 2025. Of all major markets with population growth in 2024, Chicago’s annual housing stock change of 0.7% is the lowest and is half of the 1.4% national average. (all data in this post compiled from CoStar)

However, there is a significant disparity between how Class A institutional-grade assets have performed in comparison to the rest of the market. Per Moody’s CRE, the vacancy rate differential between Class A and Class B/C assets hit an all-time high in 2024, at roughly a 440 basis point spread (Class A: 8.5% vs Class B/C: 4.1%).

Given the widespread uncertainty regarding the future of interest rates, investors are hungry for yield. Cap rates for middle-market assets remain 100-200 basis points higher than Class A assets in the same submarket. It is incredibly difficult for institutional investors to achieve positive leverage for new acquisitions given that these assets have historically traded in the 4.0-5.5% cap rate range. Buyers of Class A product are financing their purchases at interest rates in excess of 100 basis points higher than where they’re buying- thus, they are relying on significant cap rate compression to achieve their underwritten returns.

For investors of Class B/C product, negative leverage is much rarer. In many submarkets throughout the city, investors can purchase stabilized assets at in-place cap rates ranging from 6.5%-9.5%, heavily dependent on location and quality of the asset. As a result, investors are less likely to be over-leveraged while achieving significant cash-on-cash returns. We are also seeing a substantial increase in loan assumptions where existing rates are lower than what’s available in today’s debt markets. As a result, investors can buy at a lower entry cap rate while obtaining a strong yield.

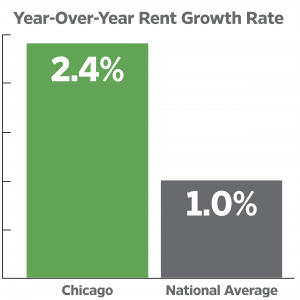

In 2024, there were six sales of Class A product to institutional investors in all of Chicago. Three of the six sold at significant discounts. 20 North Aberdeen traded for $34.5 million and the seller incurred a $5 million loss on its 2017 investment. In the South Loop, 1326 S Michigan Avenue sold for $144 million- while the project cost was $171 million. Finally, JPMorgan sold 850 N Lake Shore Drive for $79.8 million, representing a 43% discount to the previous sale. In comparison, the middle market saw a significant increase in sales in 2024. Interra Realty had a 118% increase in transaction volume for assets between 10 and 100 units in the Chicago metropolitan market. Sellers have reaped the benefits of Chicago’s annual 2.4% asking rent growth rate, double the national average.

There will be no shortage of opportunities for Chicago multifamily investors this year. It will simply be a matter of seeking out the right product in the middle market space which is our focus at Interra Realty.

Alex Cohen is an Associate at Interra Realty where he works alongside Managing Partner Craig Martin. Alex graduated from the University of Wisconsin and is a licensed real estate broker in the State of Illinois.